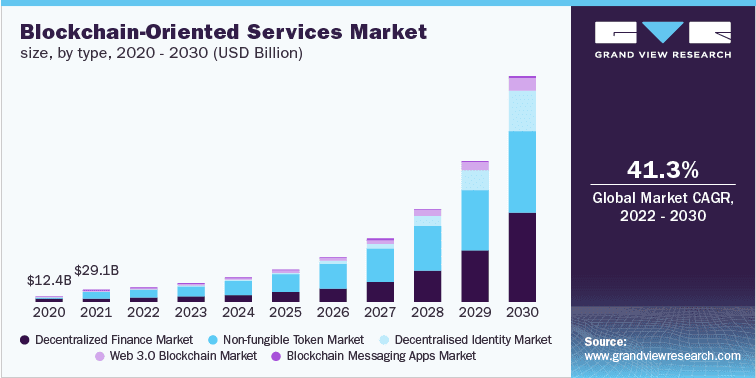

The blockchain-oriented services industry size garnered USD 29.09 billion in 2021 and will grow with a CAGR of 41.3% CAGR from 2022 to 2030, according to the “Blockchain-Oriented Services Industry Data Book, 2023-2030,” published by Grand View Research. The emergence of blockchain to bolster transparency, impartiality, and efficiency in financial transactions has prompted industry leaders to expand their penetration. The new disruptive force of digital technology has witnessed massive traction globally, with business conglomerates exhibiting interest in cryptocurrencies for accurate tracking, permanent ledger, and cost reduction. For instance, the technology can be used in the automotive sector to manage fractional ownership in autonomous cars, while the financial market could seek the ledger of transactions for quick and cheaper settlements.

With blockchain gaining publicity, Decentralized Finance (DeFi) has received an impetus to democratize financial systems, enabling anyone to access financial services without interference from any third-party intermediaries, including insurance companies and banks. The applications of digital assets, smart contracts, and wallets help create a financial ecosystem and bank the unbanked people globally. Prominently, smart contract technology has become instrumental in creating synthetic securities with borderless transfers, 24/7 liquidity, liquidity pool farming, and censorship resistance. The decentralized finance market size stood at USD 11.78 billion in 2021 and will witness around 42.5% CAGR during the forecast period.

Growing demand to remove dependence on centralized third parties has spurred the trend for decentralized identity through the use of identity wallets and blockchain. The system will help create identifiers and hold attestations without reliance on central authorities, including governments or service providers. End-users are banking on decentralized identity on the heels of individual control of information identification and portability of identity data.

Organizations have sought the identity approach to streamline auditing, limit risk, and check credentials for faster remote hiring. The decentralized identity market size reached USD 0.38 billion in 2021 and could expand at a strong CAGR of 88.2% during the assessment period. Some factors attributed to the buoyant outlook are largely attributed to increased privacy, security, data integrity, and authenticity.

Lately, blockchain messaging apps have come to the fore to provide unparalleled security, largely due to decentralized end-to-end encryption technology. Amidst the privacy dilemma, the emergence of Web3 technologies has provided a slew of opportunities to foster decentralized services. Furthermore, blockchain-built applications can provide more autonomy and control over their data and user-generated content.

Prevailing trends have prompted industry participants to bolster their positions in the global landscape. To illustrate, in April 2023, LayerZero raked in USD 120 million in Series B funding, garnering a USD 3 billion valuation. On-chain applications, including decentralized exchanges, use the protocol and the company claims it has processed more than USD 6 billion in the transactional volume.

Some dynamics that are poised to drive the industry are delineated below:

- Non-fungible Token (NFT) has received an uptake with heightened awareness regarding cryptocurrencies and to possess digital assets in online and virtual environments. For instance, NFTs can monetize digital artwork and help get royalty each time the digital asset changes hands after the initial sale.

- Stakeholders have also exhibited traction for Web 3.0 blockchain to leverage blockchain, machine learning, and AI. Blockchain will gain ground to ramp up the speed of transactions in Web 3.0 and foster healthcare, automotive, and supply chain sectors.

- Europe is likely to account for a considerable share of the global market in light of the soaring popularity of blockchain to bolster the security and transparency of transactions. The ensuing years of robust developments have triggered blockchain implementation for real-time transactions, short sales of securities, and proxy voting.

Blockchain-oriented services have fueled tremendous business value across the U.S. and Canada for enhanced creditability, traceability of material supply chain, and reduced paperwork and administrative costs. Stakeholders have also witnessed blockchain-induced disruption in financial services, healthcare, and the automotive industry. For instance, the healthcare sector has sought blockchain for a lightweight digital footprint with increased transparency for identity verification, managing data sharing, patient consent, and access permissions. The decentralized public ledger can leverage multiple verifications of vaccine certificates with a better track-and-trace system. These trends suggest leading players will likely explore opportunities in blockchain services, including DeFi, NFT, and decentralized identity, to tap into the North American market.

Major Deals and Strategic Alliances

The competitive landscape alludes to an increased emphasis on organic and inorganic strategies, including product offerings, technological advancements, innovations, partnerships, and mergers & acquisitions. To illustrate, in May 2022, Dapper Labs announced the pouring of USD 725 million to bolster decentralized finance, gaming, content creators, and infrastructure in the Flow ecosystem. Meanwhile, in January 2022, Voltage closed a USD 6 million seed round with the backing of Trammell Venture Partners with GV, Craft Ventures, and other investors. The funding will help the development of enterprise-grade Bitcoin and lighting infrastructure to rev up the scaling layers of Bitcoin.

Discover more from Gadget Rumours

Subscribe to get the latest posts sent to your email.