The global e-commerce industry size reached USD 13, 497.0 billion in 2022 and will witness a CAGR of 15% during the forecast period 2023-2030, according to the “E-commerce Industry Data Book, 2023-2030,” published by Grand View Research. Expanding the footfall of smartphones across emerging and advanced economies will foster market growth. The expansion of social commerce, in-store transformation, and omnichannel commerce will strengthen the position of leading players in the global market. A surge in online interaction and digital transformation on the back of the COVID-19 pandemic encouraged industry players to boost their penetration. End-users sought e-commerce for convenience, contactless payments, and home deliveries.

Growth Unfolds for B2B Leaders

A giant stride of digital business has spurred the footfall of B2B e-commerce. Businesses are emphasizing the buy-now-pay-later trend that has already become pronounced in the B2C market. Buyers have also shown traction for improved checkout and payment experience, including the availability of preferred payment methods. Prominently, self-service e-commerce options have received impetus across the business vertical. For instance, FAQs, visual elements, and chatbots have become the go-to options, helping businesses bolster loyalty, and increase customer retention and traffic.

Investments in consumer-focused FAQs can boost conversion rates and unlock opportunities to improve user experience. The B2B e-commerce market size was valued at USD 7,904.0 billion in 2022 and could witness a robust CAGR of 22.8% from 2023 to 2030. With e-commerce emerging as a top technology investment, online sales will likely pay big dividends for B2B sellers. In essence, industry leaders are expected to inject funds into advanced tools to enable customers to track orders and manage their accounts.

Lately, automation of key business processes has become a vital cog in the B2B operation to streamline sales, fulfillment, ordering, and back-office processes. Industry leaders are poised to explore automation in inventory, distribution, marketing, and sales. As B2B buyers have become more demanding, sellers are expected to provide personalized and enhanced online experiences to foster their product pipeline.

Underlying Opportunities for B2C Players

B2C e-commerce is likely to witness exponential growth in the wake of the surging footfall of online intermediaries, advertisement-based sites, and fee-based platforms. Businesses have furthered their investment in e-commerce to minimize overhead costs, expand customer reach, and personalize marketing. It also helps collate customer and visitor data to boost online success and tap into business opportunities. The B2C e-commerce market size was pegged at USD 4,378.9 billion in 2022 and will observe an impressive CAGR of 9.7% during the assessment period. The growing footprint of companies, such as Amazon, eBay, Meta (Facebook), and Netflix will bode well for the industry growth.

Dynamics that are poised to have a notable impact on the global market are delineated below:

- Bullish investments in e-commerce platform technology will encourage stakeholders to bolster their penetration. The growth of social media platforms, along with soaring online purchases, is poised to reinforce the position of e-commerce companies.

- Industry leaders are expected to emphasize product discovery to help customers find up-to-date information and the desired product.

- B2B merchants are poised to invest in third-party B2B marketplaces to attract new customers and buyers who purchase in higher volumes.

- E-retailers have upped their digital strategies to foster their footprint through mobile apps, omnichannel services, and social media analytics.

- Stakeholders expect North America to witness investment galore on the back of soaring traction for online shopping and a robust 5G footprint.

Stakeholders Scale Operations in Asia Pacific

Asia Pacific e-commerce industry share could be pronounced with soaring internet penetration, expansion of 5G networks, and buoyant government initiatives. For instance, the Government e-Marketplace (GeM) of India has reportedly served 12.28 million orders, translating into USD 40.97 billion, from over 5 million registered sellers and service providers as of November 2022. Furthermore, in January 2023, Walmart announced investing USD 2.5 billion in India to augment its footprint in the e-commerce and payment landscape.

Moreover, 5G smartphones have gained exponential uptake across China, India, and Japan, boosting regional growth. According to Global Times, China had 757 million 5G users in January 2022. A significant uptake in social shopping and branded shopping apps will further the penetration of Asia Pacific in the global market.

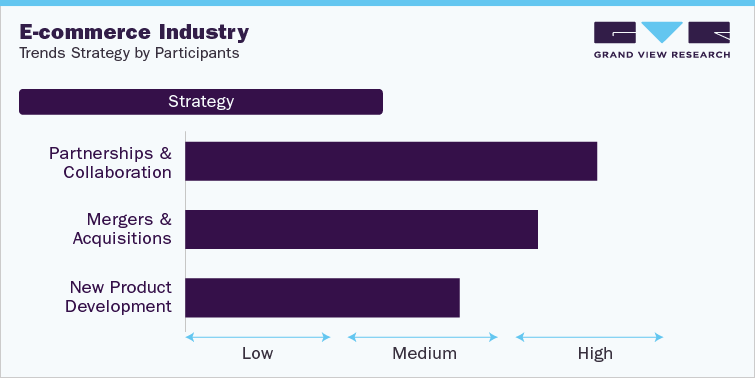

Strategic Approach to Stay Competitive

The competitive landscape suggests that organic and inorganic strategies could be pronounced with an increased emphasis on product offerings, technological advancements, innovation, collaboration, and mergers & acquisitions. For instance, in February 2023, eBay announced the acquisition of 3PM Shield to bolster its monitoring solution to avert the sale of unsafe and counterfeit products and illegal goods. Meanwhile, in April 2022, Amazon rolled out a USD 1 billion fund to foster delivery speed and enhance the experience. The bullish investment will focus on companies developing logistics, supply chain, and fulfillment technologies. In March 2023, Mercado Libre announced pouring USD 3.6 billion in Brazil in 2023. The company is poised to add more electric trucks and vans, new fulfillment centers, and planes to its fleet.

Leave a Reply